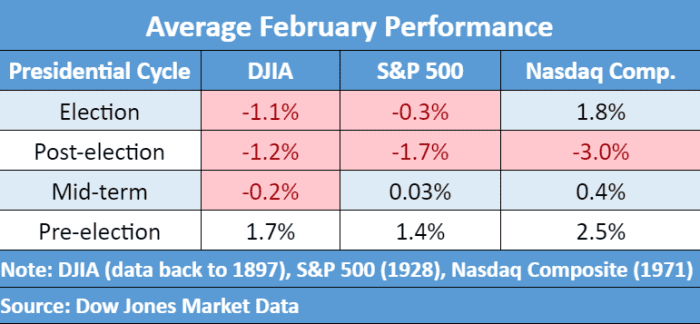

The U.S. stock market is on pace to finish the first month of 2024 on a positive note, with encouraging economic data and fresh all-time highs for the S&P 500 and the Dow Jones Industrial Average. History shows, however, that February can be a difficult month for equities, especially in a presidential election year.

Since 1928, February, on average, has delivered a negative 0.1% monthly return for the large-cap S&P 500 index SPX, the second worst month of a year on average. That decline is more than doubled in an election year, with the index suffering an average 0.3% February drop, according to Dow Jones Market Data.

Februarys in election years are also more frequently negative, with the S&P 500 ending the month down 50% of the time, versus 47.9% overall, according to Dow Jones Market Data.

SOURCE: DOW JONES MARKET DATA

Meanwhile, the Dow industrials DJIA have delivered an average of negative 0.2% monthly return in February, also good for the second worst monthly average dating back to 1897. During an election year, the blue-chip index has averaged a decline of 1.1% in February.

Furthermore, the Dow industrials have recorded negative returns 51.6% of the Februarys during election years, compared with 48% of all years, Dow Jones Market Data found.

SOURCE: DOW JONES MARKET DATA

Sam Stovall, chief investment strategist at CFRA Research, said February is a “digestion month” after a strong November-January period.

“The market needs to catch its breath,” he told MarketWatch via phone on Tuesday. “Investors want to take some profits, so February ends up being a slow period for the market.”

Since November, the S&P 500 has advanced 17.5% over the three-month period, while the Dow industrials have risen 16.1% and the Nasdaq Composite COMP has surged 21.1% over the same period. All three major stock indexes are on pace for their largest three-month percentage gains since mid-2020, according to Dow Jones Market Data.

See: Alphabet earnings: What to expect from the Google parent company

Meanwhile, February is when most U.S. companies are scheduled to report their earnings for the fourth quarter of the prior year, which is usually a “kitchen-sink quarter,” Stovall said. That means companies tend to throw “every bit of bad news” into their quarterly results to make the following year look better, but it can drag on their stock prices in February, Stovall said.

In the month of January so far, the S&P 500 has advanced 3.3%, while the Dow Jones Industrial Average is up 2.1% and the Nasdaq Composite has surged 3.3%, according to FactSet data.

Mark Hulbert: Here’s what to expect from stocks in February after January’s big rally